Credit Karma Offers

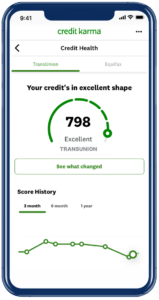

Credit Karma is a free service that offers on-demand access to your credit scores and credit report. It also provides you with tools and recommendations to help you improve your credit score. Credit Karma also helps you find loans that fit your budget and goals. Some people are skeptical of Credit Karma because they don’t want to share their personal information with a company that will use it for marketing purposes. Others are concerned that the service may be fraudulent or insecure.

Regardless of whether you’re comfortable with sharing your personal financial data with Credit Karma, it is important to note that the company uses secure encryption technology to protect its users’ information from hackers and scammers. This technology applies to both the website and its mobile applications. Additionally, the company does not sell your personal financial data to third parties.

When you sign up for the service, you’ll be asked to provide some basic information, such as your name and Social Security number’s last four digits. Credit Karma will then request a credit report from TransUnion and Equifax. This is a soft inquiry, and it will not affect your credit scores. However, if you apply for a loan or credit card through Credit Karma, the lender will perform a hard inquiry on your credit reports. These inquiries can have a negative impact on your credit scores.

Are Credit Karma Offers Legit?

The main reason to use Credit Karma is to get free credit reports and monitor your credit. It’s also an excellent tool for monitoring your identity and identifying errors on your credit report. In addition, Credit Karma can help you find special offers for balance transfer credit cards and installment loans. These offers can save you a lot of money on interest.

While the information on Credit Karma is often accurate, it’s important to keep in mind that it does not have all of your credit data. The company only works with TransUnion and Equifax, two of the three major credit bureaus. This can cause your Credit Karma scores to differ from the FICO scores used by lenders and creditors.

Another thing to consider is that Credit Karma doesn’t always update its data quickly enough. This can lead to inaccurate reports, especially if you pay off a large debt. It could also take time for the changes to appear on your credit report if a creditor hasn’t reported it.

If you’re a frequent user of Credit Karma, it may be worth adding an account with the other credit reporting agencies, such as Experian and FICO. This will give you an even more complete picture of your credit health and can make it easier to apply for loans or credit cards. Additionally, the other credit reporting agencies offer more in-depth monitoring of your credit, including things like public records. The other advantage of having an account with all three credit bureaus is that it can help you spot fraud more quickly. This is important because if you’re applying for a mortgage or auto loan, the lenders will most likely look at your credit report from all three agencies.