Trade Carbon Credits Good

Trade carbon credits are a way to offset the emissions that companies produce, and they are often referred to as carbon offsets. These credits are purchased by businesses that want to meet their environmental commitments, and they are sold to others who are trying to reduce their greenhouse gas emissions. However, if these offsets are used incorrectly, they can be a boon to criminal activity.

Since the Kyoto Protocol was adopted, carbon credits have become a major part of climate action. They can help to slow the effects of global warming. These credits can be purchased or earned for a variety of reasons, including planting trees, or helping to restore threatened ecosystems. The value of a trade carbon credits varies based on the attributes of the underlying project.

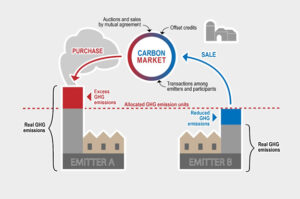

The primary aim of the carbon credit system is to reduce emissions of GHGs. These credits are traded in over-the-counter markets. While they are used by many corporations, individuals can also purchase them. The value of these credits can vary significantly depending on the supply and demand of the economy. The price of carbon credits is expected to increase dramatically over the next decade.

Are Trade Carbon Credits Good For Criminal Activity?

Those involved in the industry are calling for reform of the carbon credit market. This is especially true given the fact that there are hundreds of millions of tons of poorly-quality credits on the market. This creates the potential for error and fraud, and also makes it difficult to accurately trace them. It is not uncommon for a company to sell a credit that is not a good match to the underlying project.

The voluntary market for carbon credits is a growing industry. There are currently hundreds of carbon credit companies and organizations, some of which are based in the US. The California Cap and Trade Program is one of them.

The Clean Development Mechanism (CDM) was created under the Kyoto Protocol. It allows industrialized countries to reduce their own emissions abroad, and these credits are now available for trading in international aviation carbon-trading schemes. However, these credits have not been proven to effectively cut emissions. Some critics have argued that more than 60 percent of the credits on the market are from questionable projects.

Several factors have contributed to the high level of uncertainty in the carbon credit marketplace. A lack of clarity around the attributes of these credits creates a market with limited liquidity and unclear pricing signals. In addition, the number of projects is relatively small, so the market could struggle to generate enough financing for projects. A digital process that can verify the quality of projects would reduce the costs associated with issuance and improve the credibility of corporate offsets. The potential for money laundering is also a concern.

The global supply of nature-based sequestration, which could be used to offset CO2 emissions, is very small. Most of this potential supply is located in a few select countries. It is estimated that the market for such credits could be worth about $100 million per year.